Life Insurance in and around The Woodlands

Life goes on. State Farm can help cover it

Life happens. Don't wait.

Would you like to create a personalized life quote?

Protect Those You Love Most

When it comes to reliable life insurance, you have plenty of choices. Evaluating coverage options, providers, riders… it’s a lot, to say the least. But with State Farm, you won’t have to sort it out alone. State Farm Agent Jana Ferrante is a person committed to helping you create a policy for your specific situation. You’ll have a straightforward experience to get economical coverage for all your life insurance needs.

Life goes on. State Farm can help cover it

Life happens. Don't wait.

Wondering If You're Too Young For Life Insurance?

But what coverage do you need, considering your situation and your loved ones? First, the type and amount of insurance you opt for can be designed to fit your current and future needs. Then you can consider the cost of a policy, which depends on the age you are now and how healthy you are. Other factors that may be considered include body weight and gender. State Farm Agent Jana Ferrante can walk you through all these options and can help you determine how much coverage you need.

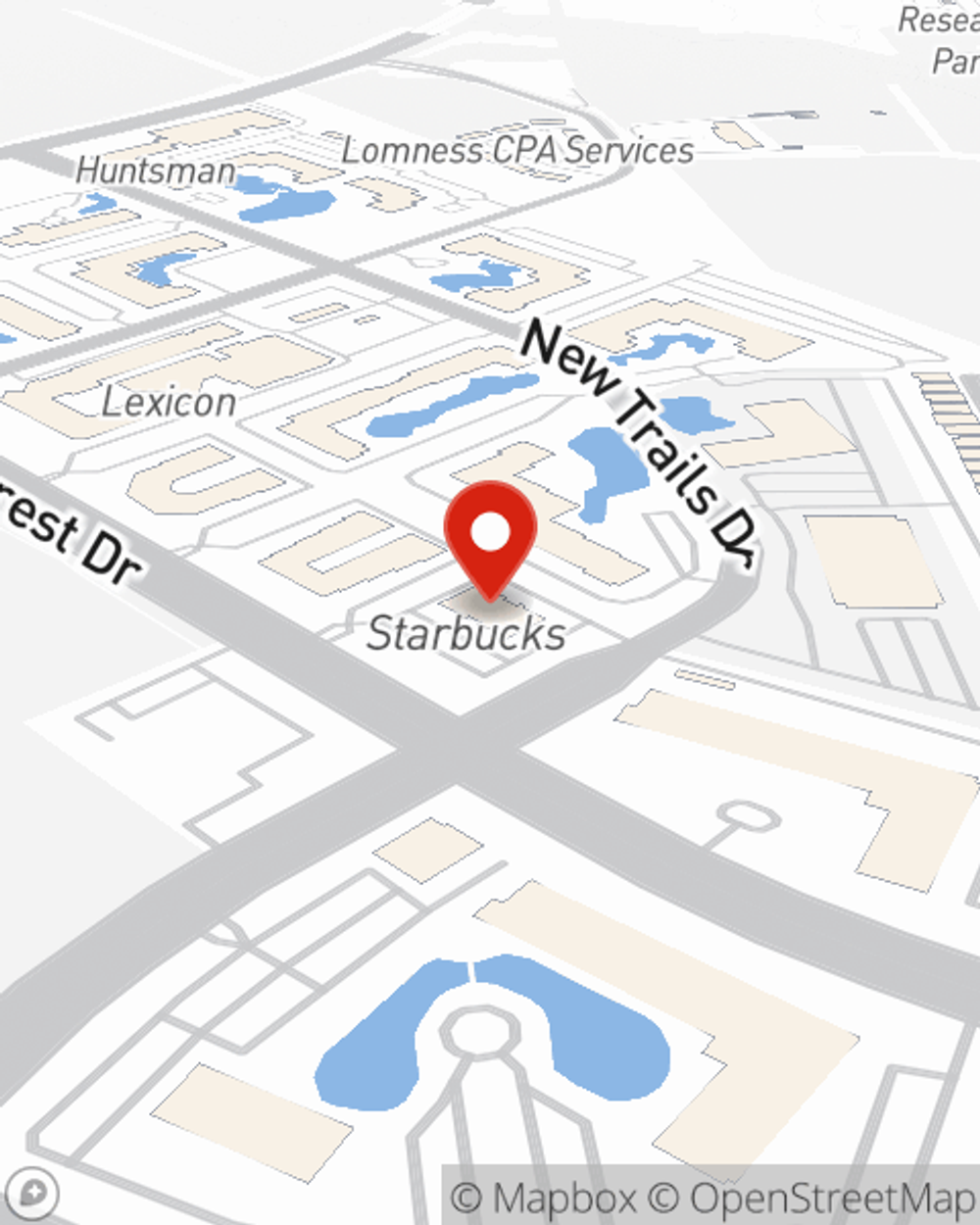

To discover what State Farm can do for you, visit Jana Ferrante's office today!

Have More Questions About Life Insurance?

Call Jana at (936) 756-4321 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Benefits of owning a life insurance policy to cover your final expenses

Benefits of owning a life insurance policy to cover your final expenses

Final expense insurance (or burial insurance) can help relieve the burden of funeral planning. We'll explore details of guaranteed issue life insurance.

How to create a retirement income plan

How to create a retirement income plan

Creating a retirement plan that works requires a balance of budgeting and savvy retirement income strategies.

Jana Ferrante

State Farm® Insurance AgentSimple Insights®

Benefits of owning a life insurance policy to cover your final expenses

Benefits of owning a life insurance policy to cover your final expenses

Final expense insurance (or burial insurance) can help relieve the burden of funeral planning. We'll explore details of guaranteed issue life insurance.

How to create a retirement income plan

How to create a retirement income plan

Creating a retirement plan that works requires a balance of budgeting and savvy retirement income strategies.